Let’s talk about something that’s as exciting as a rollercoaster ride but with way more numbers: Dow Jones futures meaning. If you’ve ever scratched your head wondering what these financial terms mean, don’t worry—you’re not alone. Whether you’re a seasoned investor or just starting out, understanding Dow Jones futures is crucial if you want to navigate the stock market like a pro. So, buckle up, because we’re diving deep into the world of futures trading, and by the end of this, you’ll be speaking the lingo like a boss.

Think of the Dow Jones futures as a sneak peek into the stock market’s mood before the official trading day even begins. It’s kind of like checking the weather forecast to see if you need an umbrella. Investors and traders use these futures to predict how the market will behave, and trust me, it’s a game-changer. But what exactly are these futures, and why should you care? That’s what we’re here to find out.

Before we dive into the nitty-gritty, let’s set the stage. The stock market can be unpredictable, and that’s where Dow Jones futures come in. They provide valuable insights that help investors make informed decisions. So, whether you’re looking to protect your investments or find new opportunities, understanding the meaning of Dow Jones futures is your first step toward financial success. Let’s get started!

What Are Dow Jones Futures?

Alright, let’s break it down. Dow Jones futures are essentially contracts that allow traders to buy or sell the Dow Jones Industrial Average (DJIA) at a predetermined price in the future. Sounds fancy, right? But here’s the thing: these contracts don’t just sit there waiting for the future to happen. They’re actively traded, and their prices fluctuate based on market sentiment, economic data, and global events.

Imagine you’re at a big party, and everyone’s talking about what’s going to happen next. Dow Jones futures are like those whispers, giving you a heads-up on what the market might do when the trading bell rings. And just like any good party, the mood can change in an instant. That’s why traders pay close attention to these futures—they’re a real-time barometer of market sentiment.

Why Dow Jones Futures Matter

Now, you might be wondering, “Why should I care about Dow Jones futures?” Great question. These futures matter because they offer a glimpse into the market’s expectations. If the futures are trading higher, it could mean that investors are optimistic about the market’s performance for the day. On the flip side, if the futures are down, it might signal caution or even fear. In short, they’re like a crystal ball for the stock market.

For traders, Dow Jones futures are more than just a preview—they’re a tool. They allow investors to hedge against potential losses or take advantage of opportunities before the market opens. And in a world where timing is everything, having that extra edge can make all the difference.

How Do Dow Jones Futures Work?

Let’s get into the mechanics. Dow Jones futures are traded on exchanges like the Chicago Mercantile Exchange (CME). When you buy a futures contract, you’re essentially agreeing to purchase the DJIA at a specific price on a future date. If the actual market price is higher than the agreed-upon price, you profit. If it’s lower, well, that’s where things can get tricky.

Here’s the cool part: you don’t have to wait for the contract to expire to make a move. Traders can buy and sell these contracts throughout the day, which makes them incredibly liquid. It’s like a game of chess where every move matters, and the board is constantly changing.

Key Players in the Dow Jones Futures Market

So, who’s behind the curtain pulling the strings? The Dow Jones futures market is made up of a diverse group of players, including institutional investors, hedge funds, and retail traders. Each group has its own strategy and goals, but they all share one thing in common: they’re looking to capitalize on market movements.

Institutional investors, for example, might use futures to hedge against risks in their portfolios. Hedge funds, on the other hand, often take more aggressive positions, betting on market trends to generate returns. And then there are the retail traders, the everyday folks like you and me, who are trying to make sense of it all and maybe turn a profit along the way.

Factors Influencing Dow Jones Futures

Now, let’s talk about what makes the Dow Jones futures tick. A whole bunch of factors can influence these contracts, from economic data releases to geopolitical events. For instance, if the Federal Reserve announces a rate hike, it could send futures tumbling as investors worry about the impact on the economy. On the other hand, strong earnings reports from major companies can boost futures, signaling optimism about the market’s health.

And let’s not forget about global events. A trade deal between two countries or a natural disaster can send shockwaves through the market, affecting futures prices in an instant. It’s like a giant game of dominoes where one event can set off a chain reaction.

Benefits of Trading Dow Jones Futures

So, what’s in it for you? Trading Dow Jones futures offers several benefits. First, there’s leverage. With futures, you can control a large position with a relatively small amount of capital. This can amplify your returns, but it also comes with risks. Second, futures are highly liquid, meaning you can enter and exit positions quickly. And third, they provide flexibility. You can go long (buy) or short (sell) depending on your market outlook.

But here’s the thing: trading futures isn’t for the faint of heart. It requires knowledge, experience, and a solid strategy. That’s why it’s important to educate yourself and understand the risks involved before jumping in headfirst.

Risks Associated with Dow Jones Futures

Speaking of risks, let’s talk about the downsides. The same leverage that can boost your profits can also magnify your losses. If the market moves against you, you could end up losing more than your initial investment. Plus, futures prices can be volatile, especially during times of uncertainty. And let’s not forget about margin calls, where your broker might demand additional funds if your position moves against you.

That’s why risk management is key. Traders often use stop-loss orders and position sizing to limit potential losses. It’s like having an insurance policy for your trades—something every smart investor should consider.

How to Trade Dow Jones Futures

Alright, you’re ready to take the plunge. How do you actually trade Dow Jones futures? First, you’ll need a brokerage account that offers futures trading. Once you’ve set that up, you can start by researching the market and identifying potential opportunities. Then, it’s time to place your trade.

Here’s a quick rundown of the process:

- Choose a futures contract based on your market outlook.

- Determine the size of your position and set your entry and exit points.

- Monitor the market and adjust your strategy as needed.

- Close your position when your goals are met or if the market moves against you.

Remember, trading is a marathon, not a sprint. It’s important to stay disciplined and avoid making emotional decisions.

Best Practices for Trading Dow Jones Futures

Now that you know how to trade, let’s talk about best practices. First, always have a plan. Know your goals, risk tolerance, and exit strategy before you even think about placing a trade. Second, stay informed. Keep up with market news and economic data to stay ahead of the curve. And third, practice patience. The market doesn’t move in a straight line, so be prepared for ups and downs.

And don’t forget about education. The more you know, the better equipped you’ll be to navigate the complexities of the market. Whether it’s reading books, attending webinars, or following industry experts, there’s always something new to learn.

Understanding Market Sentiment Through Dow Jones Futures

Market sentiment is a big deal, and Dow Jones futures are a great way to gauge it. Think of sentiment as the collective mood of investors. If the futures are trading higher, it could mean that optimism is in the air. If they’re down, it might signal fear or uncertainty. By paying attention to these signals, you can make more informed decisions about your investments.

But sentiment isn’t just about numbers. It’s also about psychology. Investors’ emotions can drive market movements, and understanding those emotions can give you a competitive edge. So, whether you’re a seasoned pro or just starting out, learning to read the market’s mood is a valuable skill.

Tools for Analyzing Dow Jones Futures

Now, let’s talk about tools. There are plenty of resources available to help you analyze Dow Jones futures. Charting software, for example, allows you to visualize price movements and identify trends. News aggregators keep you up to date on the latest developments, while economic calendars help you anticipate important data releases.

And don’t underestimate the power of community. Online forums and social media platforms are great places to exchange ideas and learn from others. Just remember, while these tools can be helpful, they’re no substitute for knowledge and experience.

Real-World Examples of Dow Jones Futures in Action

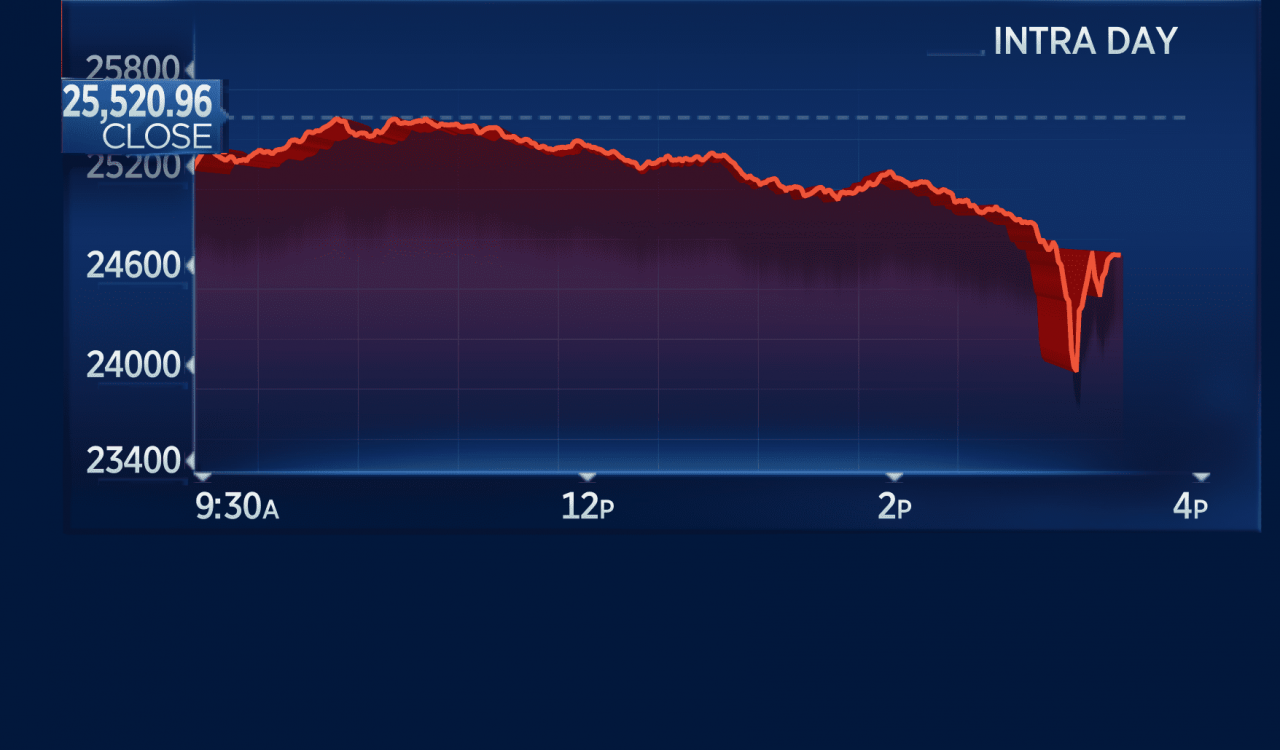

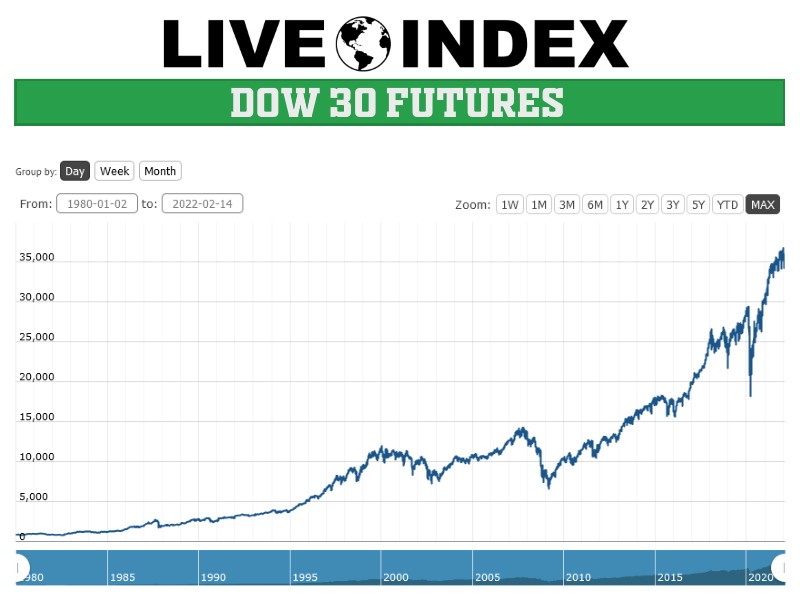

To really understand Dow Jones futures, let’s look at some real-world examples. During the 2008 financial crisis, futures markets were in turmoil as investors panicked about the state of the economy. Prices swung wildly as traders tried to make sense of the chaos. On the flip side, during the tech boom of the late 1990s, futures markets soared as investors poured money into internet stocks.

And then there’s the more recent example of the pandemic. When lockdowns were announced in early 2020, Dow Jones futures plummeted as investors braced for the economic impact. But as vaccines were developed and economies began to reopen, futures rebounded, reflecting renewed optimism about the future.

Lessons Learned from Historical Events

History has a lot to teach us. By studying past events, we can gain insights into how markets behave under different conditions. For example, during times of uncertainty, investors tend to flock to safe-haven assets like gold and bonds. In contrast, during periods of economic growth, they’re more likely to invest in stocks and other riskier assets.

These lessons can help us make better decisions in the present. By understanding how markets have reacted in the past, we can anticipate how they might behave in the future. And that’s a valuable skill for any investor.

Conclusion

And there you have it, folks—a comprehensive look at Dow Jones futures meaning and why they matter. Whether you’re a seasoned trader or just starting out, understanding these futures can give you a leg up in the stock market. They provide valuable insights into market sentiment, offer flexibility and leverage, and allow you to take advantage of opportunities as they arise.

But remember, with great power comes great responsibility. Trading futures comes with risks, so it’s important to educate yourself and manage those risks wisely. Stay informed, stay disciplined, and most importantly, stay curious. The market is constantly evolving, and the more you know, the better equipped you’ll be to navigate its twists and turns.

So, what are you waiting for? Dive in, explore, and discover the world of Dow Jones futures. And don’t forget to share your thoughts and experiences in the comments below. We’d love to hear from you!

Table of Contents

- What Are Dow Jones Futures?

- Why Dow Jones Futures Matter

- How Do Dow Jones Futures Work?

- Key Players in the Dow Jones Futures Market

- Factors Influencing Dow Jones Futures

- Benefits of Trading Dow Jones Futures

- Risks Associated with Dow Jones Futures

- How to Trade Dow Jones Futures

- Best Practices for Trading Dow Jones Futures

- Understanding Market Sentiment Through Dow Jones Futures

- Real-World Examples of Dow Jones Futures in Action